Part 1 of a multi-part research series from AQR: “Understanding Return Expectations” (downloadable at bottom of post with my highlights).

The key concept in this paper is that individual investors tend to extrapolate heavily from recent market results, while institutional traders and capital market assumptions tend to be more “rationally anchored and contrarian.”

Investors may be losing faith in [capital market assumptions] and going all-in with the rearview-mirror mindset just when there appears to be dangerous bumps in the road ahead.

Forward-looking assessments, while imperfect, do have some positive predictive value have positive correlation of .52. Review-mirror approaches, on the other hand, are inversely correlated -.37.

The paper also discusses why individual investors might be pre-disposed to subject rearview-mirror thinking, based on Kahneman’s fast vs. slow thinking framework: “[…] past performance comes easily to mind, while required discount rates need more effortful thinking.”

The paper calls out the following 3 reasons to avoid rearview predictions in 2025:

- A too-positive directional view of risky and private assets

- A too-negative view on various diversifying alternatives

- A too-positive relative view on US equity market exceptionalism

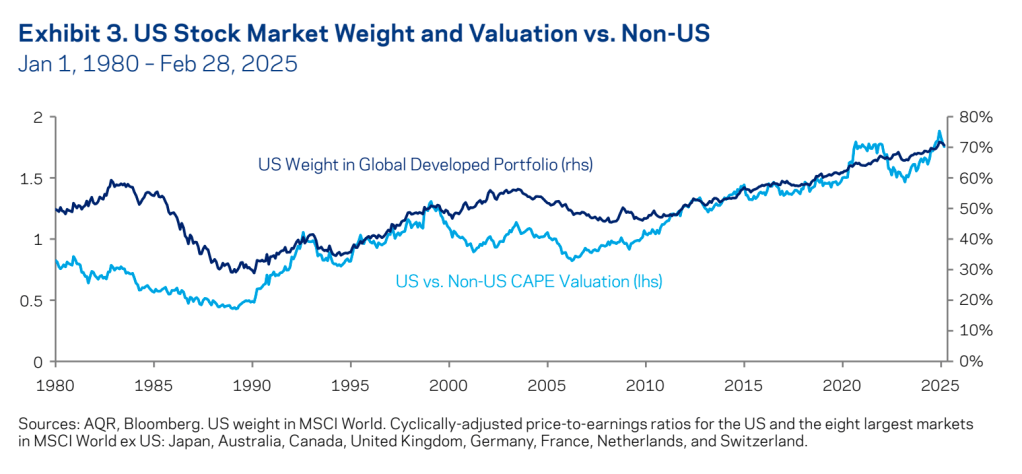

I am personally very interested that last one. Knowing that investment returns are a relative game, why would you choose to invest in a cap-weighted benchmark placing 72% of your invested assets in the US at a nearly all-time-high relative CAPE?

All these features coincide at the time of writing in the US vs rest of the world equity trade. Not surprisingly, then, US relative valuations reached almost twice the level of other developed markets near year-end 2024, having been at half-valuation level in 1990 and hovered near unity between 1995 and 2010. Despite record-high relative valuation, investors accepted a record-high 72% US weight in the MSCI developed markets index. [emphasis mine]

The real trouble with this world of ours is not that it is an unreasonable world, nor even that it is a reasonable one. The commonest kind of trouble is that it is nearly reasonable, but not quite. Life is not an illogicality; yet it is a trap for logicians. It looks just a little more mathematical and regular than it is; its exactitude is obvious, but its inexactitude is hidden; its wildness lies in wait.

G.K. Chesterton